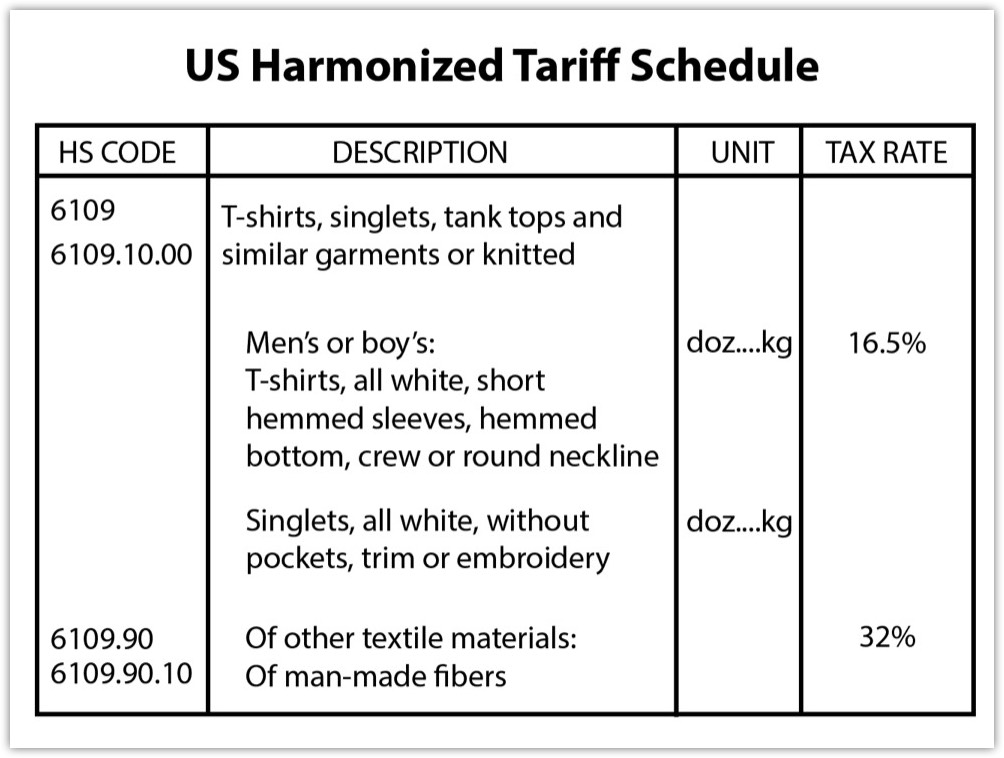

First, you need to know about HS Codes. HS Codes come from the Harmonized Tariff Schedule. This system was created by the World Customs Organization (WCO) to categorize goods into approximately 5,000 commodity groups.

This system is accepted and implemented by more than 200 countries worldwide. This classification system is used to determine US import duty rates for goods imported into the USA. The HTS, first, classifies a garment based on its name, use, and/or the material used in its construction. Then, it assigns a ten-digit classification code-number to the garment. With that number you can look up the US import duty rates.

Let’s walk through a simple example.

Let’s say you are making plain 100% t-shirts using knitted fabric. What is the US import duty rate?

1. Go to this website: 2016 HTSA Supplement Edition

2. Download the ‘Full Document’

3. Scroll down to Section XI

4. Find Chapter 61 and read the notes

5. Find SubHeading 6109.10.00

Here you will see that the general US import duty rate for t-shirts made with cotton is 16.5%.

Let’s walk through another example.

Let’s say you are making a woman’s dress shirt made with 100% polyester woven fabric. What is the US import duty rate?

1. Go to this website: 2016 HTSA Supplement Edition

2. Download the ‘Full Document’

3. Scroll down to Section XI

4. Find Chapter 6206

5. Find SubHeading 6206.40.30

Here you will see that the US import duty rate for a woman’s shirt of man-made fibers is 26.9%.

You can download the Harmonized Tariff Schedule (HTS) from their website, www.usitc.gov, but be sure to use the actual HTS and not the data web version. Near the upper right hand corner of the ITC web page, there is a box with a blue label that says ‘Tariff Assistance’. In that box there is place that says “view” with “Current official HTS by chapter” as the first option listed. Click on that; then select the chapter you want from the table of contents. You can also get to the tariff by clicking on the ‘Tariff Affairs’ on the light blue band across the top of the page. General note 3, found at the beginning of the Harmonized Tariff System (HTS), explains the columns and abbreviations used throughout the tariff. The section notes at the beginning of Chapter 50 apply to all of the textile and apparel chapters in the HTS.

The International Trade Commission office edits and publishes the Harmonized Tariff Schedule (HTS). You can contact Nomenclature Analyst for Textiles, Apparel and Footwear, if you have any detailed questions.